The Lending industry survives on the quality of services it delivers to the customers. Most people do their banking in commercial banks as opposed to Investment banking. Lending firms earn money by lending loans and earning interest income from those loans. It can be difficult to reach out for financial assistance; hence it is important to make this process: straightforward, simple, and fast.

Borrowing money shouldn’t involve unnecessary hurdles.

These loan providers prefer and opt, providing installment loans through a quick, easy online application process that offers confidentiality and security.

Lenders and financial institutions have been impacted by the downfall of sub-prime lending rates. In order to get its process back on track and build a reliable yet robust financial enterprise architecture, there is a huge potential for technology partners to carve out effective solutions.

These concerns also bring with it an equal potential to capitalize on banking needs and turn challenges into opportunities to make a name in the current and future. It is here that the creative approach of Insight Consultants comes to the fore.

Our approach gives you ample time to visualize and to justify how we can add immense value to our IT skills. We ensure that all processes that are designed and deployed are customer-oriented and use competitive intelligence.

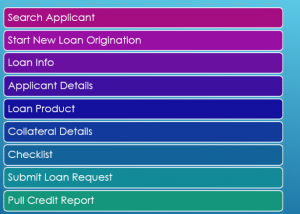

A Loan Origination software solution should be specifically designed considering the following features

· Dynamic

· Easy to use

· Truly mobile

· Highly configured

· Secure

The software we develop provide end to end application and support to manage the following type of loans for Lenders / Financial institutions.

· Consumer Lending

· Online lending

· Business Lending

· Indirect lending

The process is simple and customized to meet the specific requirements of the Lender, thus enhancing the value.

We focus on making lending easy and secure. Here are a few things that you should look for in a lending application.

1. Payments Scheduling: Being able to make regular payments as installments.

2. Customizable alerts: Being able to receive text, email and push notifications (account alerts, bill pay reminders, security alerts), and more

3. Testing: Being able to test an application is a necessity, and the company you opt for should be able to undertake functional and security testing.

4. Adapt new technology: Being able to adapt to the latest technologies is necessary, as only then will you be able to get robust solutions.

Technology today is so advanced, that Lending firms lean towards these web applications, to enhance their customer satisfaction as it’s customized to match their specific needs.