Your lending business is always changing. To keep up with the competition, firms need a customized loan processing solution that quickly and easily adapts as your business grows. But there are several challenges that lenders and borrowers must face in their loan closing journey. So, what are some of those major loan origination challenges and how software can address.

Here we have come up with 3 major challenges in loan origination and how software addressing those:

Improving transparency: Most lenders still follow traditional methods for loan processing. They use spreadsheets, calendars and notebooks to track their outstanding. It’s challenging to track the performance or measure the progress.

With an integrated solution, however, customer information from the core gives lenders a contact database to work with and creates a centralized place for logging conversations. The added transparency of an integrated relationship system means the institution can better service customers and management has a means by which it can hold lenders accountable for progress toward activity goals.

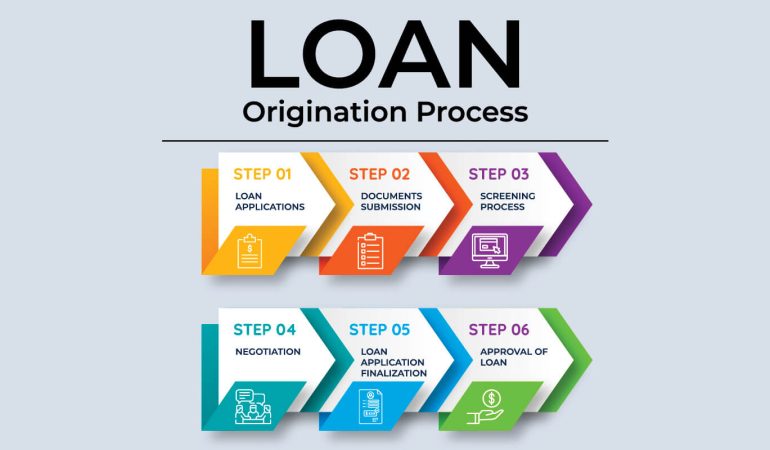

Optimizing the loan origination process: Completing a loan cycle is a long process and that involves many roadblocks. From credit analysis to loan approval, sometimes the process can go for months to complete. Major obstacles include, high risk of fraud, difficulty in receiving documents from branches, extended period of loan application consideration, complicated search for documents in the paper archive etc.

But now with the help of advanced software technologies, loan origination can be well tailored. With custom made solution, integrated software solutions also empower management to identify and remedy bottlenecks, which once addressed, can improve turnaround time for new loans and give the institution a competitive edge over other institutions vying for a borrower’s business.

Tracking outstanding post-closing documents: This stage of loan management starts immediately after loan closure and includes trailing critical documents. This can lead to greater institutional risk with respect to, among other things, proper lien perfection, inadequately insured collateral and regulatory scrutiny.

Here an automated, centralized system that allows for the creation of ticklers and exception reporting is invaluable. This workflow process also allows for the identification of patterns that may single out a deficient closing agent or branch that needs to strengthen documentation compliance. An effective and efficient software can make your loan origination simple. Do you have the effective technology to streamline your origination process? Let Insight Consultants help. Contact Us